3 Easy Facts About Clark Wealth Partners Explained

Some Known Incorrect Statements About Clark Wealth Partners

Table of ContentsEverything about Clark Wealth PartnersOur Clark Wealth Partners StatementsUnknown Facts About Clark Wealth PartnersFascination About Clark Wealth PartnersThe Only Guide to Clark Wealth PartnersThe Best Guide To Clark Wealth PartnersMore About Clark Wealth Partners

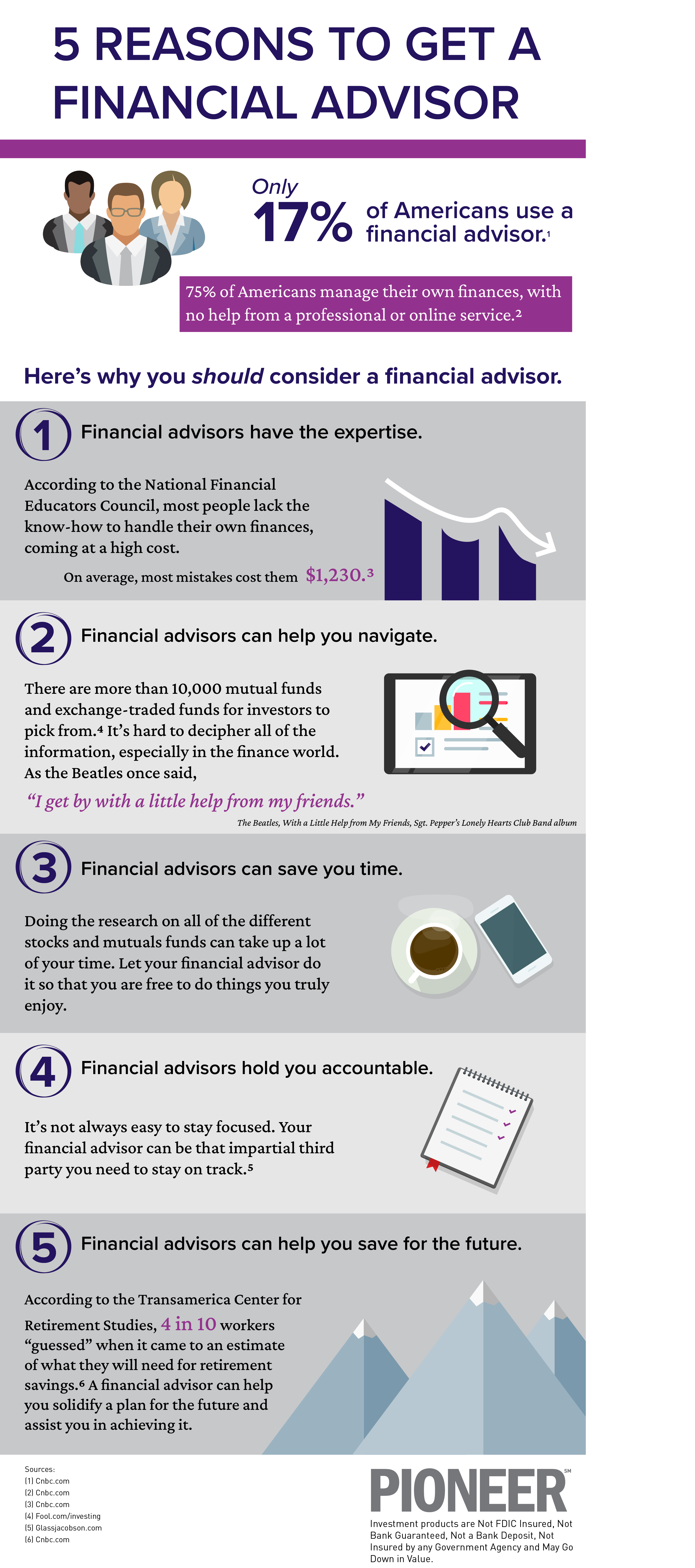

The globe of money is a complex one., for instance, just recently discovered that nearly two-thirds of Americans were unable to pass a standard, five-question monetary literacy examination that quizzed individuals on topics such as passion, debt, and various other reasonably standard concepts.In enhancement to handling their existing clients, monetary consultants will commonly invest a fair quantity of time every week meeting with possible clients and marketing their services to retain and grow their business. For those considering becoming a monetary advisor, it is very important to take into consideration the ordinary salary and task security for those working in the area.

Programs in tax obligations, estate planning, investments, and risk administration can be practical for trainees on this path as well. Depending on your distinct profession objectives, you may additionally require to earn specific licenses to satisfy particular customers' requirements, such as dealing stocks, bonds, and insurance coverage. It can likewise be useful to earn a certification such as a Certified Monetary Organizer (CFP), Chartered Financial Expert (CFA), or Personal Financial Professional (PFS).

The Only Guide to Clark Wealth Partners

Lots of people determine to get aid by using the services of an economic professional. What that looks like can be a number of points, and can differ depending upon your age and phase of life. Prior to you do anything, research study is essential. Some individuals worry that they require a certain quantity of cash to invest prior to they can obtain help from an expert.

The Clark Wealth Partners PDFs

If you have not had any experience with an economic consultant, right here's what to anticipate: They'll begin by providing a comprehensive assessment of where you stand with your possessions, responsibilities and whether you're meeting standards compared to your peers for cost savings and retired life. They'll assess short- and long-term goals. What's helpful concerning this step is that it is individualized for you.

You're young and functioning full time, have a car or 2 and there are trainee finances to repay. Below are some feasible ideas to aid: Develop excellent cost savings behaviors, settle financial debt, set baseline objectives. Repay trainee fundings. Relying on your career, you may qualify to have part of your college finance waived.

About Clark Wealth Partners

Then you can review the next best time for follow-up. Prior to you start, ask regarding pricing. Financial consultants usually have various tiers of rates. Some have minimum possession levels and will charge a charge typically several thousand bucks for producing and adjusting a strategy, or they may bill a level cost.

You're looking in advance to your retirement and helping your youngsters with greater education expenses. A monetary expert can provide recommendations for those scenarios and more.

Clark Wealth Partners for Dummies

That may not be the finest method to keep building wide range, particularly as you advance in your occupation. Set up routine check-ins with your coordinator to tweak your strategy as required. Balancing savings for retired life and university prices for your youngsters can be difficult. A financial consultant can aid you focus on.

Thinking of when you can retire and what post-retirement years might resemble can create problems about whether your retirement cost savings are in line with your post-work strategies, or if you have conserved sufficient to leave a tradition. Help your economic specialist understand your strategy to cash. If you are Continue more conventional with conserving (and prospective loss), their pointers should react to your fears and worries.

The 9-Second Trick For Clark Wealth Partners

Planning for health treatment is one of the large unknowns in retired life, and a financial professional can lay out alternatives and recommend whether extra insurance policy as defense might be handy. Before you start, try to get comfortable with the concept of sharing your entire economic image with a professional.

Offering your expert a full image can help them create a strategy that's prioritized to all components of your economic condition, specifically as you're rapid approaching your post-work years. If your financial resources are basic and you have a love for doing it on your own, you may be great by yourself.

A monetary expert is not only for the super-rich; anybody facing major life changes, nearing retired life, or feeling bewildered by economic decisions could gain from specialist guidance. This write-up explores the function of monetary advisors, when you might need to consult one, and key factors to consider for picking - https://justpaste.it/js7e3. An economic expert is a skilled expert that helps clients manage their funds and make informed choices that align with their life goals

The Basic Principles Of Clark Wealth Partners

In contrast, commission-based consultants gain income via the economic products they offer, which may affect their referrals. Whether it is marriage, separation, the birth of a youngster, career adjustments, or the loss of a liked one, these occasions have unique financial implications, typically calling for prompt decisions that can have long-term results.